The old saying “you snooze, you lose” is especially applicable to saving for retirement.

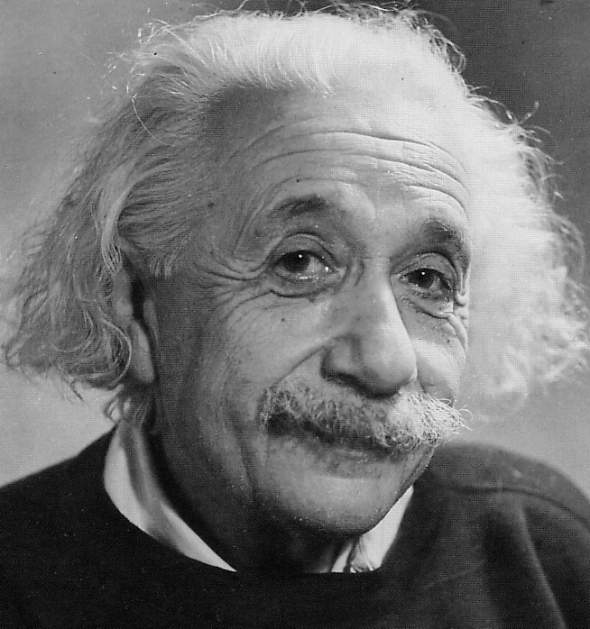

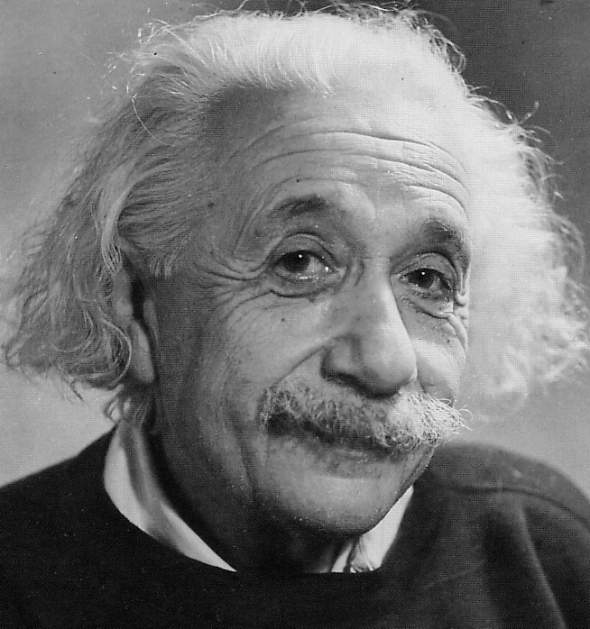

No lesser a genius than Albert Einstein once declared “the power of compound interest” to be “the most powerful force in the universe.” That’s probably true; and the second most powerful force is arguably the power of regular saving. Together, they’re “thermonuclear” in power—but only if they have enough time to operate.

For example: based on reasonable historical assumptions, a 55-year-old will have to put away $610 per month in order to have $100,000 saved up by age 65. If he or she had started 10 years earlier, only $216 per month would need to be saved in order to achieve the same result. And if the savings program had begun at age 25, only $50 per month would suffice!