The old saying “you snooze, you lose” is especially applicable to saving for retirement.

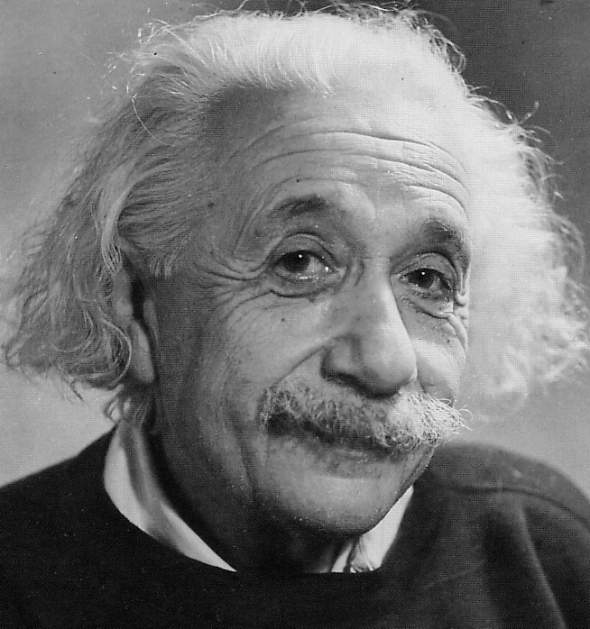

No lesser a genius than Albert Einstein once declared “the power of compound interest” to be “the most powerful force in the universe.” That’s probably true; and the second most powerful force is arguably the power of regular saving. Together, they’re “thermonuclear” in power—but only if they have enough time to operate.

To get an idea of just how powerful the combination of compound interest, regular saving, and time are, consider the following table. It shows how much you must put away every month if you wish to have a modest nest egg of $100,000 available when you retire. In putting it together, we made the following assumptions:

- Money invested in the stock historically has yielded a 10% return on average over time.

- Inflation has averaged around 3% but is increasing, so we’ll be on the conservative side and assume 4%. We’ve therefore only used a compound interest factor of 6%. In other words, we’ve calculated what it will take to save up $100,000 in today’s real dollars.

- We’ve disregarded taxes, since we’re assuming you’ll save the money in a tax-deferred account. Yes, you’ll have to pay tax on the money later, but you’ve saved the tax today. We have not taken into account the fact that tax rates could change; but even if they do, you will probably be in a lower bracket during retirement than while you’re still working.

- We’re assuming you want to retire at age 65 and base your starting age accordingly.

Based on these assumptions, here’s how much you will have to save each month depending on when you start:

| Starting Age | Years Until Retirement | Monthly Amount Needed |

| 60 | 5 | $1,433.00 |

| 55 | 10 | $610.00 |

| 50 | 15 | $344.00 |

| 45 | 20 | $216.00 |

| 40 | 25 | $144.00 |

| 35 | 30 | $100.00 |

| 30 | 35 | $70.00 |

| 25 | 40 | $50.00 |

| 20 | 45 | $36.00 |

The numbers speak for themselves. Think about it… and then, if you don’t have a retirement savings plan yet, get started today!